A lot of people write in and ask ‘Norman - whatever happened to that SIPP you started 10 years ago ? Has it produced enough to retire on ? Was it a lot of work ? Did it outperform the FTSE100 ?’

I took the ’long term buy and hold forever and ‘strategic ignorance’ ethos to its logical extreme and forgot about the SIPP completely. Once all the pension funds were transferred and a collection of high yielding UK shares purchased, I forgot about it. I didn’t sell any shares. I didn’t feverishly check the balance daily. I didn’t panic during the banking crisis of 2008. I didn’t respond to any corporate actions. Occasionally, I bought a new share once enough funds had accumulated from dividend payments.

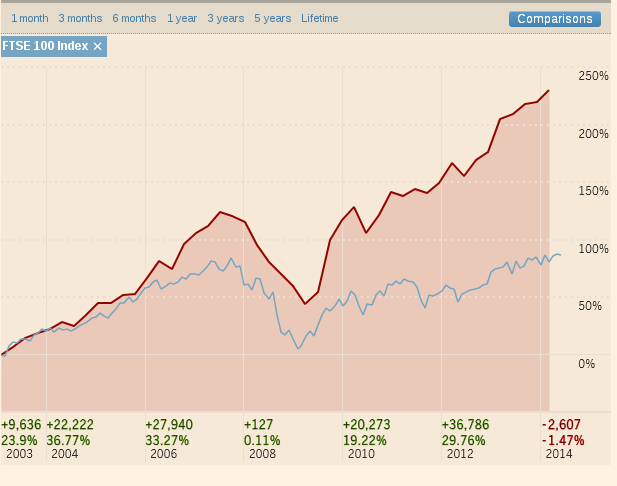

The long term performance of my SIPP versus the FTSE also interested me so recently, I endured the time consuming, arduous and rather tedious exercise of reconstructing the detailed transaction and dividend history, spanning 11 years, of my pension portfolio which produced an interesting graph (courtesy of ft.com).

Not enough to retire on but getting there.

Update: A better comparison is with the FTSE100 (accumulation units) where dividend income is automatically re-invested.